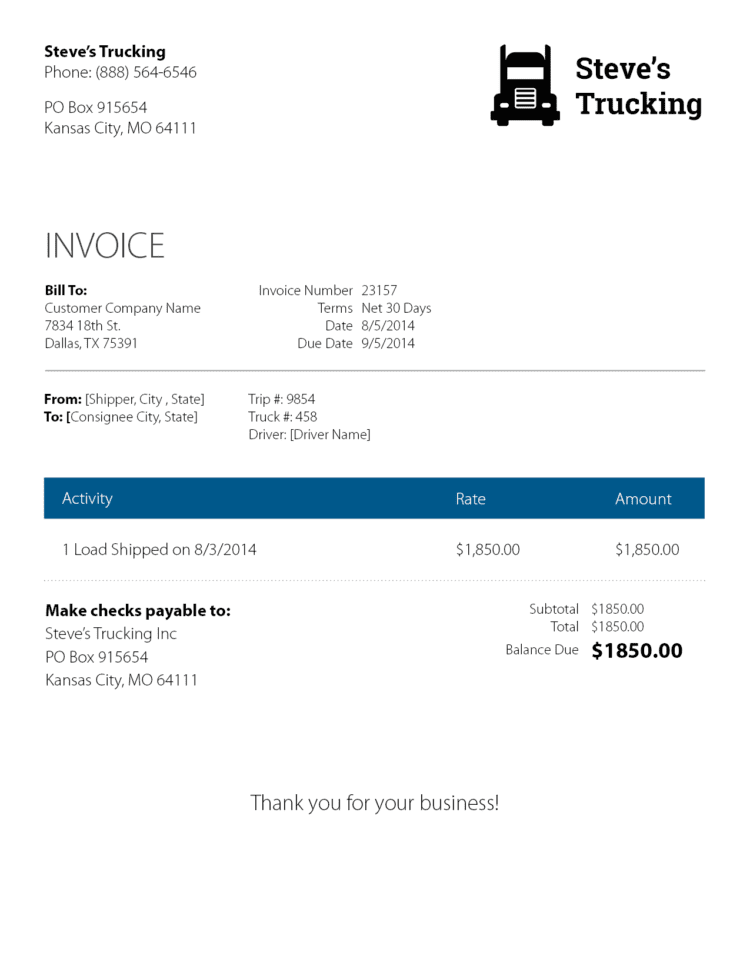

How Is Invoice Factoring Different Than a Bank Loan? Once the factor is paid, the remaining 10% of the invoice value will be paid to the contractor, minus the factoring fee. The factor sends the invoice to the customer and will collect payment in 30-60 days. The factor verifies completion of work and advances up to 90% of the invoice within 24 hours.

Once his service is completed, he send his invoice to the factoring company instead of the municipality, his customer. In order to solve his cash flow problem, he chooses to factor his invoices. In the meantime, he needs to pay his employees and purchase materials for his next job. Let’s take a look at a sample invoice factoring scenario:Ī contractor doing maintenance for municipalities is billing for completed work but won’t collect payment for 30-60 days. The factoring company now owns the invoices and will collect according to the payment terms of the unpaid invoices from the customer who is being invoiced, typically 30-60 days. The factoring company provides immediate capital for those invoices. A company sells its unpaid invoices to the factoring company at a discount. Invoice factoring greatly reduces the time for receipt of payment and funding.Invoice factoring is a financial service used to boost a company’s cash flow. Start-ups and small businesses often are constrained in cash flow while waiting for outstanding invoices to be paid.

Invoice factoring template full#

Start-up companies often use receivables factoring to generate capital and thereby bring business operations to full capacity quickly. With this type of funding, you will receive a line of credit based on your company’s current invoices. Many types of businesses benefit from invoice factoring including but not limited to staffing, distributors, services providers, technology industries, manufacturing firms and transportation companies.

Invoice factoring template professional#

Professional management of your accounts receivable.We purchase your invoices and alleviate funding issues, so that you can focus on your business. Capital Funding Solutions can work with any size business, and any dollar amount. We can factor invoices as large as $5,000,000.00 and as small as $100.00. Instead of having to wait a couple of weeks for a bank to approve financing and process your loan, you can have an accounts receivable factoring application approved within 24 hours.Often, advances are initiated within 24 hours of invoices being submitted for factoring.When appropriate, we develop a combination of programs to meet our clients’ needs.You can receive an advance of up to 85% of the face value of your invoices.With us, you can receive online reports and manage your account at no extra cost. We buy your invoices to lessen monetary issues so that you can focus on growing your business. We are a one-of-a-kind factoring company that factors invoices from $ 100.00 to $5,000,000.00. provides invoice factoring to entrepreneurs, start-ups and small businesses. Invoices are purchased so that you will not have to wait for your clients to pay in order to continue business operations.Ĭapital Funding Solutions, Inc.

THIS IS A TEST Invoice factoring is a working capital funding process whereby your company receives a line of credit based on current invoices.

0 kommentar(er)

0 kommentar(er)